Try a Free Week!

Find your flow with a week of free unlimited yoga.

Core Class Types

Yoga Sculpt

Cardio + Weights

Yoga, cardio and strength moves boost metabolism and build lean muscle.

CorePower Strength X

Strength Training

Power your potential in this heart-pumping, strength training workout with energizing breathwork.

CorePower 1

Fundamental Flow

Explore the fundamental principles and postures of Vinyasa yoga with no added heat.

Find the right Membership For You

All Access Membership

Unroll your mat everywhere with unlimited access to studio, outdoor, livestream and on-demand classes (surcharges may apply in New York).

Studio Class Packs

Get access to our studio classes anytime with a variety of flexible class packs available for purchase—no membership required!

At Home Membership

Whether you're at home or on the go, our digital membership gets you access to unlimited livestream and on-demand classes.

We believe yoga can power transformation—on and off the mat

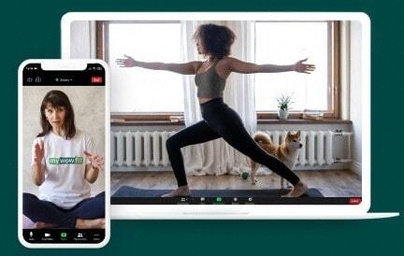

View Our Platforms

Join Us in Studio

We're open and ready for you! Find a studio near you to start flowing.

Stream Live on Zoom

Connect with teachers and students across the U.S. in 100+ real-time classes per week.

Take Class On Demand

Choose from our ever-growing library of classes for everyone, at every level.

Glowing Reviews

Our students share why they love CorePower Yoga!

"It is really empowering to see how your body can do so much. Being able to see that growth from class to class and just the changes in your own body and your strength, and your willpower to push a little bit harder is awesome."

"My favorite class is CoreRestore. I like to say that sometimes the hardest part of our practice is just getting still, and I think that every single human being on this planet could benefit from just stopping, and breathing, listening not just to their body but to themselves."

"My CorePower routine is my superpower! My practice helps me be consistent with self-care and self-love. I find myself craving it and when I come out of a class I feel renewed — out of my head and into my soul!"

Book Your Class

Find and book yoga classes at our studios or online

Available Classes

Yoga Sculpt

Downtown Studio • Sarah Johnson

CorePower 1

Online • Mike Chen

CorePower Strength X

Uptown Studio • Lisa Rodriguez

Memberships & Packages

Choose the perfect plan for your yoga journey

All Access Membership

- Unlimited studio classes

- Unlimited online classes

- Guest passes included

- Retail discounts

- Priority booking

Studio Class Pack

- 10 class pack: $220

- 5 class pack: $125

- Single class: $25

- No expiration

- Transferable

At Home Membership

- Unlimited online classes

- Live stream classes

- On-demand library

- Mobile app access

- Cancel anytime

CorePower Shop

Yoga Mats

From $45

Apparel

From $35

Accessories

From $15

Learn Yoga

Discover the fundamentals and deepen your practice

Beginner's Guide

New to yoga? Start here with our comprehensive guide to yoga basics, poses, and breathing techniques.

- Basic poses and alignment

- Breathing techniques

- Yoga philosophy

- What to expect in class

Class Types Explained

Understand the different styles of yoga we offer and find the perfect class for your goals.

- Vinyasa Flow

- Hot Yoga

- Yoga Sculpt

- Restorative Yoga

Wellness Resources

Enhance your practice with our collection of wellness articles, videos, and meditation guides.

- Meditation guides

- Nutrition tips

- Injury prevention

- Mindfulness practices

Free Practice Videos

20-Minute Morning Flow

Start your day with energy

Beginner Yoga Basics

Learn fundamental poses

Evening Relaxation

Unwind and restore

Teacher Training

Transform your practice and inspire others

200-Hour Yoga Teacher Training

Join our comprehensive teacher training program and deepen your practice while learning to guide others on their yoga journey.

Program Overview

- 200-hour certification

- Yoga Alliance registered

- Weekend intensive format

- Experienced instructors

- Small class sizes

Curriculum

- Anatomy & physiology

- Yoga philosophy

- Teaching methodology

- Sequencing & alignment

- Business of yoga

Investment

- Early bird: $2,495

- Regular price: $2,795

- Payment plans available

- Includes all materials

- Lifetime support